An antimony mine was worked at Clontibret, County Monaghan in the early 1800’s. The antimony mine shafts were dewatered in the 1950’s and back channel samples assayed leading to the first discovery of gold in the area with grades of up to 34.98 g/t recorded. Subsequent drilling in the vicinity of the antimony mine tested positive for gold but the assessment of grade was hampered by poor recovery.

Modern drilling techniques employed by Conroy Gold resulted in good recovery with grades comparable to those recorded in the back channel samples.

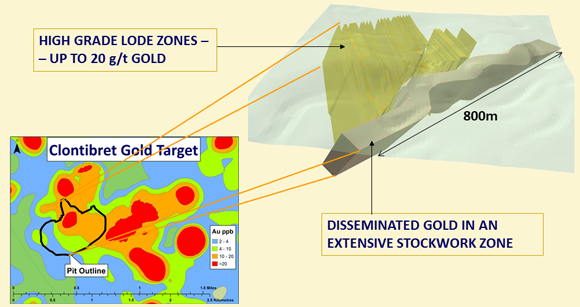

The local geology at Clontibret consists of Ordovician sedimentary rocks, which lie some 1,500 m north of the regional-scale Orlock Bridge Fault. The stratigraphy is made up of alternating units of argillite (shale or siltstone) and arenite (greywacke or sandstone) rocks. The mineralisation in Clontibret occurs in two styles - high grade lodes and a disseminated stockwork zone.

The Clontibret gold target and wireframe model of high grade lodes and stockwork zone.

The Company is now planning its first operational gold mine on 20% of the Clontibret area.

Mine scoping studies have been completed on a prior resource of 0.6m Oz I&I at 1.6 g/t Au with positive technical and financial results. . A minimum mining width of 2 metres, a long term gold price of US$1,372 and a cut-off grade of 0.60 g/t gold was used. T

For the purposes of the study a conventional open pit operation based on a long term gold price of US$1,372/Oz resulted in contained gold of 441,200 Oz. Parameters includes a head grade during mine life of 1.53g/t gold, a process rate of 800,000 tonnes per annum, an assumed overall gold recovery of approximately 85 per cent and a mine life of 11.2 years with in-situ gold averaging over 50,000 Oz per annum in the first five years. Capital costs (including sustaining capital) were estimated at US$77.8 million, with a payback period of two years.

The economic evaluation was based on a pre-tax financial model, taking a base case price for gold of US$1,372/Oz over the 11.2 year mine life. This gave a 49.4 per cent Internal Rate of Return (IRR) and a Net Present Value (NPV), at 8 per cent discount rate, of US$72.3 million.

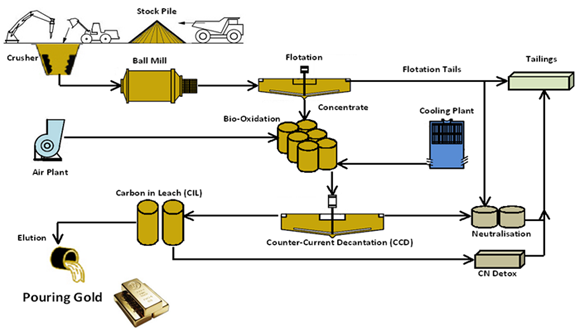

On this basis an initial process was proposed: after conventional crushing, milling and flotation to produce a bulk sulphide concentrate containing the majority of the gold, the bio-oxidation process will then convert the majority of the sulphides in the concentrate to oxide. This will then permit a conventional Carbon in Leach (CIL) and elution process for the recovery of gold to be employed. See Figure below for a schematic of this process. A comprehensive test work programme has been carried out to fully assess the metallurgical characteristics of the ore prior to finalising the process.

The scoping study concluded that biological oxidation is an appropriate technology to be considered for treating the ore, as the Clontibret ore is refractory in nature; with the bulk of the gold occurring as sub-microscopic inclusions within arsenopyrite

Environmental Studies

Base line environemnt studies have been iniciated on the project , which are a key element in the planning process for mine development.

Further environemental studies may include hydrology, hydrogeology, socio-economic, soil and land uses, historic environment and cultural heritage, air quality, noise and vibration, nature conservation, landscape and visual impact, traffic and transportation, consultation with stakeholders, treatment processes, tailings disposal and a detailed restoration plan.

Further Potential at Clontibret Gold Target

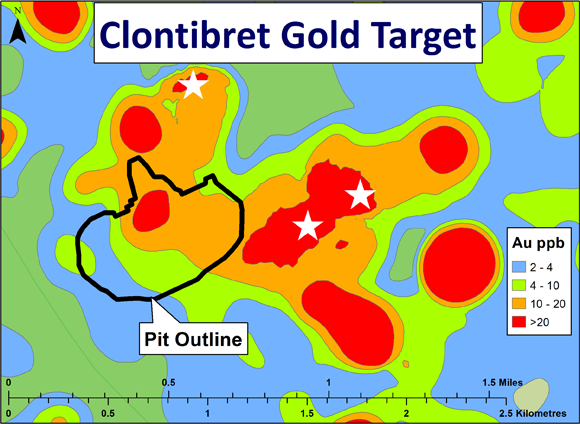

The ore system remains open at Clontibret with potential for expansion of the resource. Gold has been intersected in other areas in the remaining 80% of the Clontibret target (e.g. 11 m @ 5.34 g/t Au and 21 m @ 1.82 g/t Au)

Clontibret Gold Target showing Open Pit outline and stars showing gold intersections already identified in remaining 80%.